However, what if you face any health issues and are unable to do your duty? In that case, for few years or for forever you may not be in a position to earn. This is with respect to the economy or slowdown in your profession. The best example to prepare is having enough emergency corpus (ideally around 6-24 months of your monthly expenses including the EMI part also). Hence, already have the plan to face such situations. However, due to the economic crisis, you may face job loss or a dip in your income (if you are self-employed). Many of us are in the wrong notion that our income is fixed. However, during your loan tenure, you may face certain expected risks.

When you go for a home loan, then we always think that the EMI is comfortable for your income range and it will remain the same forever for you. # Some unexpected risks of committing to long-term home loans

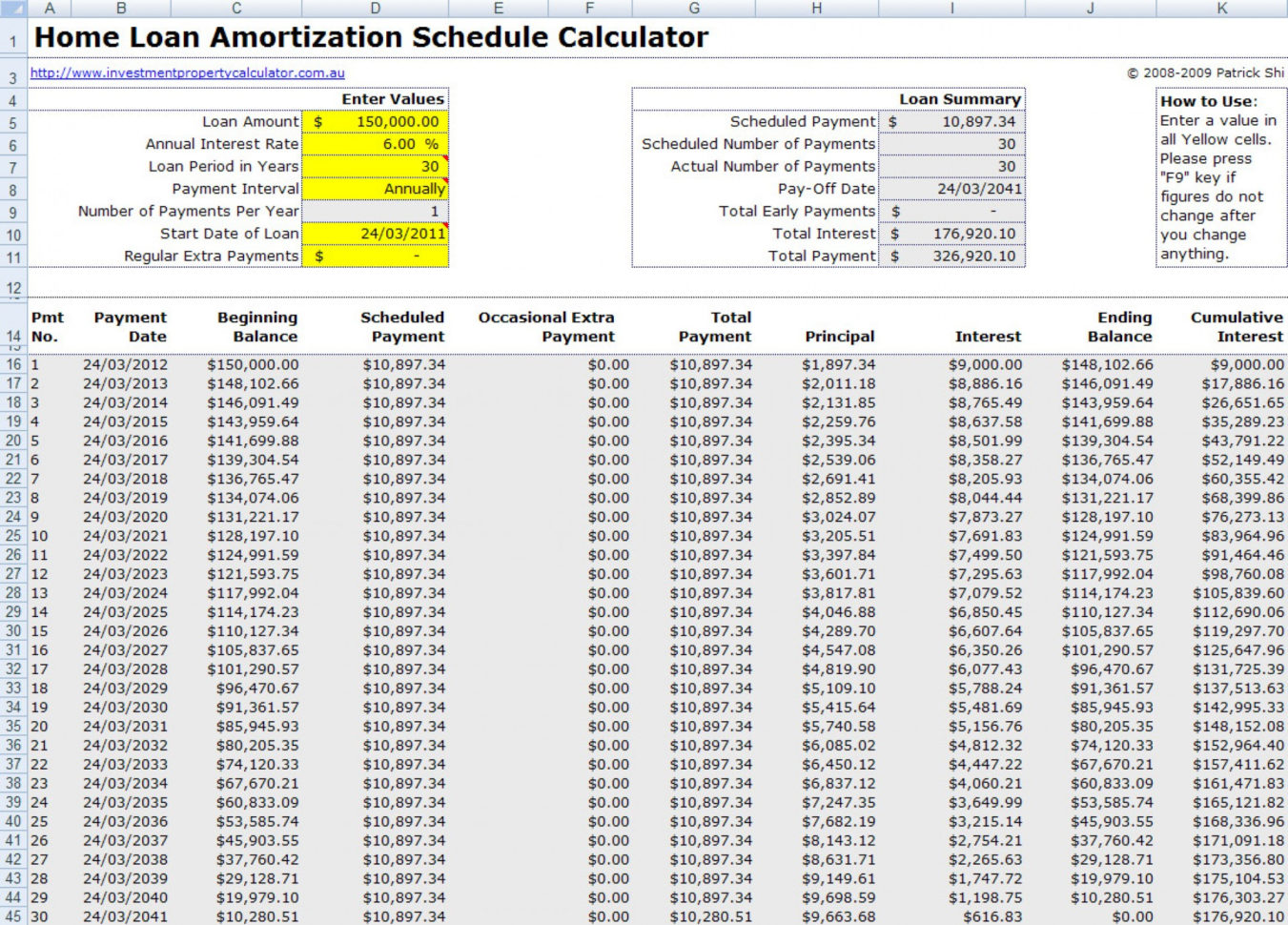

One is if you opt for prepayment along with regular home loan EMI and another one is regular home loan amortization. In this excel, you have two types of amortization tables.

#Amortization mortgage calculator balance paid excel download

Download Home Loan EMI Calculator 2023 – Free Excel Sheet Here is a link to download the free excel sheet. Along with the fixed repayment options like monthly (or as per your choice) and yearly, you have the option to enter irregular repayments.

0 kommentar(er)

0 kommentar(er)